Andreas Grüning (1785 – 1842) German born (Hamburg/Altona), Norwegian banker, consul general for Hamburg and owner of the iron works in South Odalen (North of Christiania), established the banking company A. Grüning/Grünning & Co. He also traded in woods and other merchandise and had ownership in Haflsund (Sarpsborg) – Anne passed the manor on her way from Svinesund and up to Christiania – and in 1835 Hafslund became a consortium under the leadership of A. Grüning.

Difficulty in finding Gruning and company till 12.10 then left them to settle and walked about the quays near ¾ hour (…) back to the bank – exchange at 4 speciedaler 116 skilling per £1

– Anne Lister, Travel Journal 1. August 1839

[margin: Received 248 speciedaler 40 skilling exchanged at 4/116]

Received chez Messers Gruning & Company Christiania Exchange 4 species 116 skilling per £1 2 circulars notes 8584.8585 £50 = 248 species 40 skilling

– Anne Lister, account book 1. August 1839

Received 248 speciedaler 40 skilling exchanged at 4/116 Paid on leaving Christiania to Messers Gruning for my packet to Hammersleys (the postage to Hamburg, 1 species and 5 skillings and for postage to Hamburg of Ann’s 2 letters one to her sister and 1 to her aunt 108 skilling= 4 marks 12 skilling

– Anne Lister, account book 2. August 1839

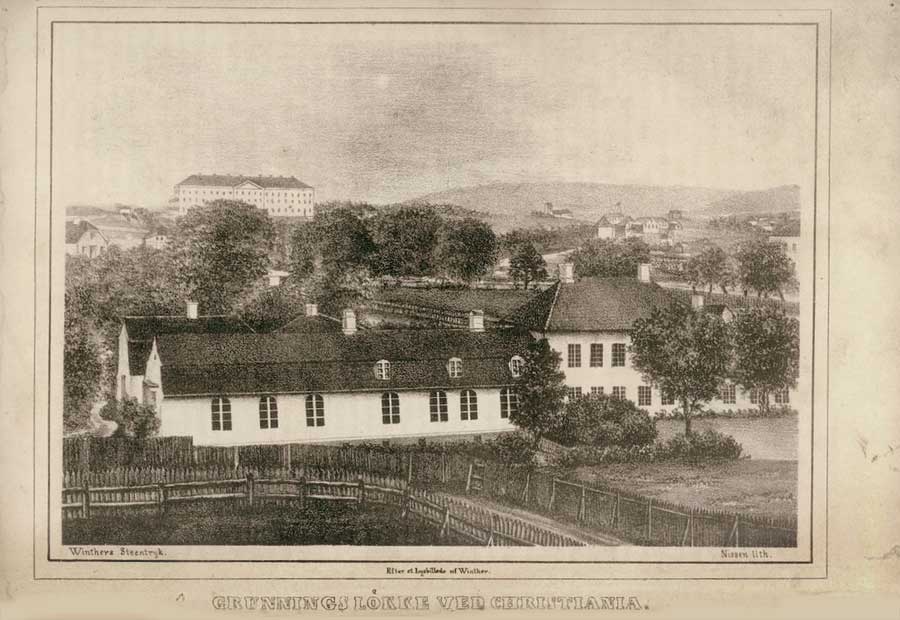

A. Grüning owned a sizeable property (løkkeeiendom) in Christiania called Grünings løkke, (see image at top of page) also sometimes referred to as Marselienborg as this was established by Selius Marselis in the 1600s. The grounds covered areas from (incl.) today’s Eidsvolls plass (the square/park outside today’s parliament) and reached all the way down towards the Christiania fjord (Oslofjorden). After A. Grüning died in 1842 the old Drammensveien (now Stortingsgata) was extended dividing the property in two. In 1846 Grünings widow therefore sold the upper part (between Stortingsgate and Karl Johansgate, and making room for Eidsvolls plass etc.)

Grüning married Anne Johanne Eleonore Turretin (1790-1872), and among his children were daugther Ida Cathrine Grüning (1821-1854) who married Herman Wedel Major, a pioneer in Norwegian psychiatry who established Gaustad hostpital in 1855.

“The London and Halifax Connections” – Grüning, Huth and the Rawsons

The Huth connection

The book The Globalization of Merchant Banking before 1850: The case of Huth & Co By Manuel Llorca-Jaña (2016) mentions Grüning as the Norway contact:

“68 In Norway, Andreas Gruning & Co was of tremendous importance, sending Huth wool, timber while also receiving a wide range of manufacturers and primary products” “22 Helping to foster the connection with Norway, it is wort mentioning that their main contact there was Andreas Gruning & Co. (Christiania) Huth & Co and this company had extensive dealings in wool. In exchange Huth sent them sundries (i.e. all sorts of goods, including ink, hardware, iron chain, coffee, lead, soap, sugar and tin plates.)

Frederick Huth & Company was a British bank established in 1809 by German-born British merchant Frederick Huth. The bank became part of British Overseas Bank in 1936. Following the death of Frederick Huth Jackson in 1921, Frederick Huth & Co was in an increasingly parlous state, and the Governor of the Bank of England pushed for it to be amalgamated with Konig Brothers, which duly happened in 1923.

Huth was the only London merchant-banker that decided to go global before 1850, and also the only one to open a branch in Chile. Huth & Co. of London, a business started in the English capital in 1809 subsequently opened branch houses in Chile and Peru during the mid-1820s; at first Huth, Coit & Co. and later on Huth, Gruning & Co. John Gruning [John Frederick Gruning of Bremen] was the first partner taken by Frederick Huth in the London business. [I have not had opportunity to establish the/any connection between John F Gruning and Andreas Grüning yet, other than to point out the many circumstantial “evidences” of name, Huth’s connections with A. Grüning and Bremen’s close proximity to Hamburg where A. Grüning was born and later consul general].

The Rawson connection

In another book by Manuel Llorca-Jaña; The British Textile Trade in South America In the nineteenth Century (1912) it becomes clear that at least for the South American textile trades of Huth’s the main bank is Rawson’s of Halifax, namely by Edward Rawson, the nephew of Christopher and Jeremia Rawson and the others:

For instance, for local houses with head offices in Britain, bills were drawn against the head office in favor of the consigner. That is, Huth, Gruning & Co. (Valpariso) would draw against Huth & Co. (London) in favor or Edward Rawson of Halifax. (p.169)

So, it seems more than likely that Anne Lister had been introduced to the Christiania banker via the Rawsons.

The Rawsons of Halifax

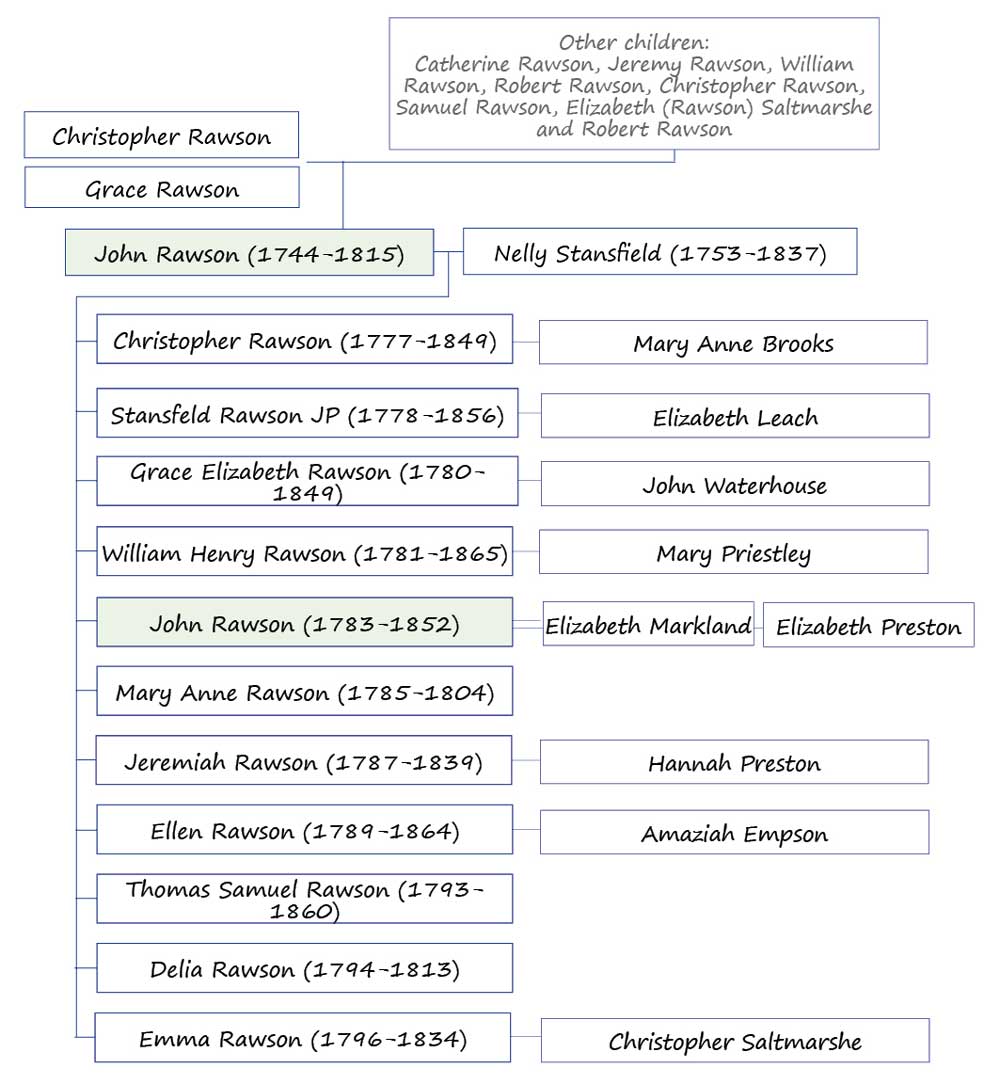

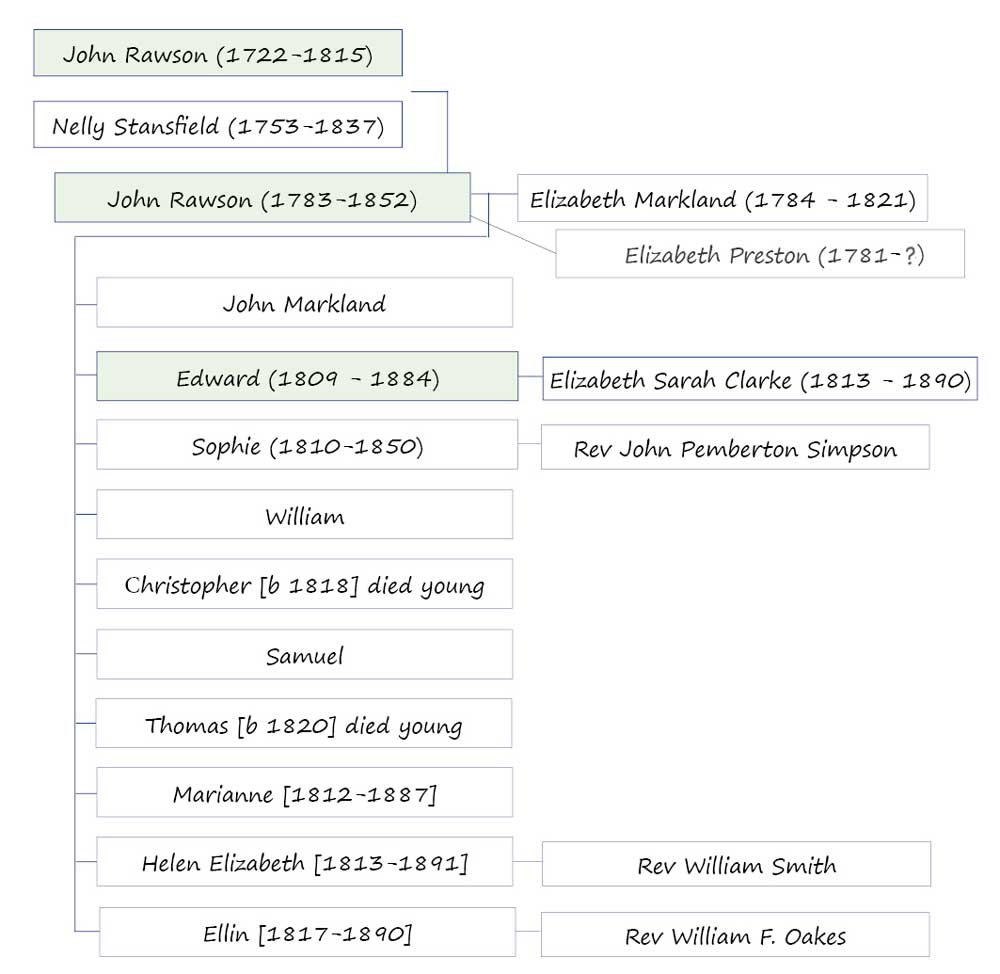

Edward Rawson of Halifax, the textile and banking connection of Huth, Gruning & Company (Valparaiso) was the son of John Rawson (1783-1852) and Elizabeth Markland and grandson of John Rawson (1744-1815) and Nelly Stansfeld (1753-1837)

Extract of Rawson Biography at Ancestry.com family tree:

“John Rawson (1744-1815) was descended from a family of woolen fabric and clothing manufacturers. In 1807, with his brother William Rawson, rawdon Briggs, and John Rhodes he established the Halifax New Bank, in Halifax, Yorkshire. This bank was dissolved in 1811, giving rise to Rawson’s Bank. The bank underwent several name changes over the course of the next century and finally merged with Lloyds Bank in 1919. In 1777 Rawson married Nelly Stansfield (1753-1837), the only surviving daughter of David Stansfield, a cloth merchant from Leeds, and his wife, Ellen Aldred. John and Nelly Rawson had twelve children: Christopher, Stansfield, William Henry, John, Jeremiah, Thomas, Grace, Ellen, Emma and three others. The Rawson family resided at Stoney Royd, a house built in 1764 for John’s father, Christopher Rawson. According to Engleheart’s fee book, he painted miniatures of Mr. and Mrs. Rawson in 1803 and again in 1810, the Cincinnati paintings probably represent the earlier of the two commissions.”

more from ghgraham.org:

“John Rawson 1744-1815 was born on 1 December 1744, the eldest son of Christopher Rawson and Grace Rawson. Like his father, he was a trustee of the Halifax to Rochdale turnpike which was constructed in the 1820s. He inherited Stoney Royd House. He owned Whitegate, Siddal, Copperas House, Siddal, and property at Ashday, Southowram. Nelly Stansfeld 1753-1837 was born about 1757, the only surviving daughter of David Stansfeld and Ellen Alred. On her coming-of-age, she received £3,000 from her father. She married John Rawson and went to live at Stoney Royd. She purchased Hope House, her family home, for her son Christopher on his marriage. She was buried at Holy Trinity Church, Halifax.”

THE RAWSONS INVOLVEMENT IN BANKING:

“This bank was the foundation stone of the present Leeds District of Martins Bank Limited, and although incorporated only just over a century ago the origins of its predecessors go back to the early days of the industrial growth of Halifax and district.

Records of these early days are few and incomplete, but mention is made as early as 1779 of a partnership between Timothy Hainsworth, Adam Holden, Robert Swaine and William Pollard of Halifax.

Holden died about 1780 and in 1802 Robert Swaine apparently parted company with his other associates and took in his brothers as partners, trading under the style of Bros. Swaine & Co., The Halifax Commercial Bank. The Halifax Commercial Bank survived a crisis in 1803 but could not endure a second in 1807, and on July 10th, Bros. Swaine & Co., met their creditors at the Talbot Inn, Halifax. Three of the important creditors and assignees of the firm, William Rawson, John Rhodes and Rawdon Briggs are believed to have purchased the business. At any rate, on July 18th, 1807, these three along with John Rawson, the brother of William, established the Halifax New Bank, in George Street. Rhodes and Briggs were already in partnership at Seville Green and evidently this militated against harmony in the new firm for in 1811 the partnership was broken up, the two Rawson’s taking in a relative and establishing the firm of John, William and Christopher Rawson, which was a forerunner of the West Yorkshire Bank Ltd.”

John Rawson of Ash Grove, Halifax, was born in 1783. He was the son of John Rawson and Nelly Stansfeld. He was in banking with his brothers Christopher and William Henry. He was Deputy Lieutenant of the West Riding / a Commissioner of Land & Assessed Taxes (1845) / a Commissioner of Property & Income Tax (1845).

In October 1806, he married Elizabeth Markland (17??-1821). Elizabeth was the second daughter of Edward Markland (merchant) of Westminster and Leeds

He was married on the same day as his brother William. Around 1820, he lived at Ash Grove, Southowram. In 1823, after the death of his first wife, John married Elizabeth Preston. They had no children He passed away in 1852.

Edward Rawson was born in 1809. He was the second son of John Rawson and Elizabeth Markland. He was a woollen cloth merchant / a Commissioner of Land & Assessed Taxes (1845). In 1831, he married Elizabeth Sarah Clarke. Elizabeth Sarah was the daughter of John Clarke of Dublin and Maria Kenny, his wife, of Willfield County Dublin.

Children:

John (b 1833) – never married

Edward Markland (b 1834) – died young

Frances Esther (b 1838) – never married

Edward Markland (b 1845) – never married

Courtney Clarke

Maria Louisa Markland (b 1845) – never married

The family lived at Ash Grove, Southowram (1841), The Breck, Triangle (1871)

Edward died in Clavedon, Somerset (1884) aged 75.

Sources

Main source: Wiki tree